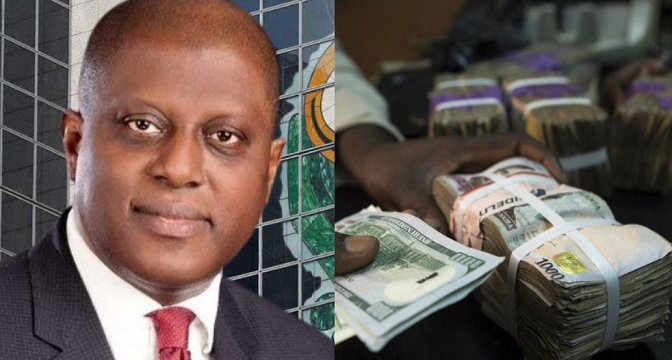

* CBN takes the flak

A resurgence of widespread and intense cash rationing by banks have compounded the economic challenges confronting Nigerians, driven by high prices of goods and services.

The House of Representatives, however, asked the Central Bank of Nigeria, CBN, to urgently address the situation which has disrupted economic activities, causing significant hardship to citizens.

Reports said banks have pegged cash withdrawal limits ranging from N5,000 to N10,000 for over-the-counter and automated teller machine (ATM) transactions.

Bank customers, in separate interviews, narrated bitter experiences in withdrawing cash from the banks.

Bank officials attributed the development to limited cash supply from the Central Bank of Nigeria (CBN) and a decline in cash deposits by customers.

The development is in spite of a recent warning by the Central Bank of Nigeria, CBN, which directed banks to ensure efficient cash disbursement to customers Over-the-Counter (OTC) and through ATMs as the CBN will intensify its oversight roles to enforce this directive and ensure compliance.

Additionally, the CBN, in a circular signed by the CBN’s acting Director of Currency Operations, Solaja Olayemi, and its acting Director of Branch Operations, Isa-Olatinwo Aisha, urged members of the public who are unable to obtain cash Over-the-Counter or through ATMs at DMBs, to report such instances using the designated reporting channels and format provided, the CBN had also promised.

In Lagos, for instance, many banks, as of Tuesday, dispensed limited amounts of cash, while some ATMs were literally dry.

At a supposed new generation bank in the Ikotun area, cash withdrawal had been pegged at N10,000 from the ATM, and N10,000 for across the counter.

Other bank customers were allowed to withdraw N20,000 across the counter, and N20,000 from the ATM. Non-customers of the bank could only access N5,000.

Customers of a new generation bank were allowed to withdraw up to N10,000 across the counter, and N20,000 from the ATM.

Yet there were long queues at the ATM points of some of the banks, reflecting the severe difficulty of accessing cash.

At a new generation bank on 2nd Avenue in FESTAC Town, Lagos, customers were only allowed to withdraw N10,000 over the counter, while the ATMs were not dispensing cash.

Another new generation bank at 511 Road paid customers N100,000 over the counter, while non-customers could get N25,000 at N5,000 per withdrawal. However, as at 12:37 pm on Tuesday, the ATMs had stopped dispensing cash.

A new generation bank at Mile 12 gave customers N40,000 over the counter, but limited non-customers to N10,000. Sterling Bank in Ketu offered N20,000 over the counter and N50,000 through ATMs.

An old-generation bank limited cash withdrawals to N10,000 over the counter, but offered up to N50,000 for withdrawals of N1,000 or more. Some customers in the banking hall who requested between N30,000 and N50,000 in their withdrawal slips were asked to complete another slip with a lower cash withdrawal request in line with the limit of the bank which ranges between N10,000 to N20,000.

Most of the banks showed cash limitation of N10,000.

Customers of the banks were allowed to withdraw the N10,000 at once but non-customers withdraw N5,000 twice.

A bank customer, Mrs. Yetunde Usman, lamented: “I don’t have an ATM card because the ATM terminals in these banks have swallowed three of my cards this year. As a result, I stopped applying for cards and I only do cash withdrawals from my bank.”

Also expressing her frustration, Miss Bamgbose Adura said: “You will have to pay N200 to get N5,000. Before, it was N100. This has pushed many people to visit the banks. But the situation at the bank is worrisome.”

A bank staff member, who spoke on condition of anonymity, said: “The CBN, has not supplied us with cash. So, we have to give out the little we have.

“Also, you know that many customers don’t make deposits during this period. They give cash to Point of Sales (PoS) and operators instead of bringing it to the bank.”

In several interviews with bank workers, the claim is that “the CBN is experiencing cash crunch and as such, banks do not have cash available for customers”.

*Media Report